NEWS HEADLINES – Globally, L’Oréal said the beauty market value has fallen 13-14% in the first half of the year, with luxury beauty, professional beauty, makeup, and fragrance sales all falling around 25%.

As per a recent study by Boston Consulting Group in association with Altagamma, it is predicted that COVID-19 can bring down global luxury sales between 30 billion euros to 40 billion euros. With the store closures and customers staying under lockdown, the luxury market has been severely hit. The industry will see the sector’s value drop to 309 billion euros (around 335 billion) a 5-year low.

How is Covid threatening the big brands and luxury living?

What are luxury goods?

Luxury goods, also called superior goods, are products with a demand that is directly related to consumer income exponentially. The dependence on luxury goods of individual consumers as well as the economy is defined by the income largely with respect to the taste and preferences of consumers.

Not just that, demand is also affected by consumer saving and spending decisions concerning ongoing crises or trends in society. Luxury items are not considered necessary for all to survive but do determine the standard of living.

The population of an economy whose income and economic circumstances are highly volatile is generally consumers of normal goods — seeing a relatively small proportion of consumers in the luxury market. Large economies with high standards of living engage more in luxury concepts.

Pre-Covid: Market Trends

Pre-covid, the luxury goods market was emerging as a big part of the revenue of world economies. People being more conscious of their health and spending extra income for better services proved to be a high demand factor. Demand for goods like expensive skincare, beauty products, clothing for both men and women, grooming services, and high-end utility products was increasing due to the increasing incomes of consumers.

The global luxury goods market size was about USD 316.16 billion in 2019. Europe’s luxury market share increased from USD 99.41 billion to USD 103.86 billion from 2018 to 2019.

How did COVID impact the market?

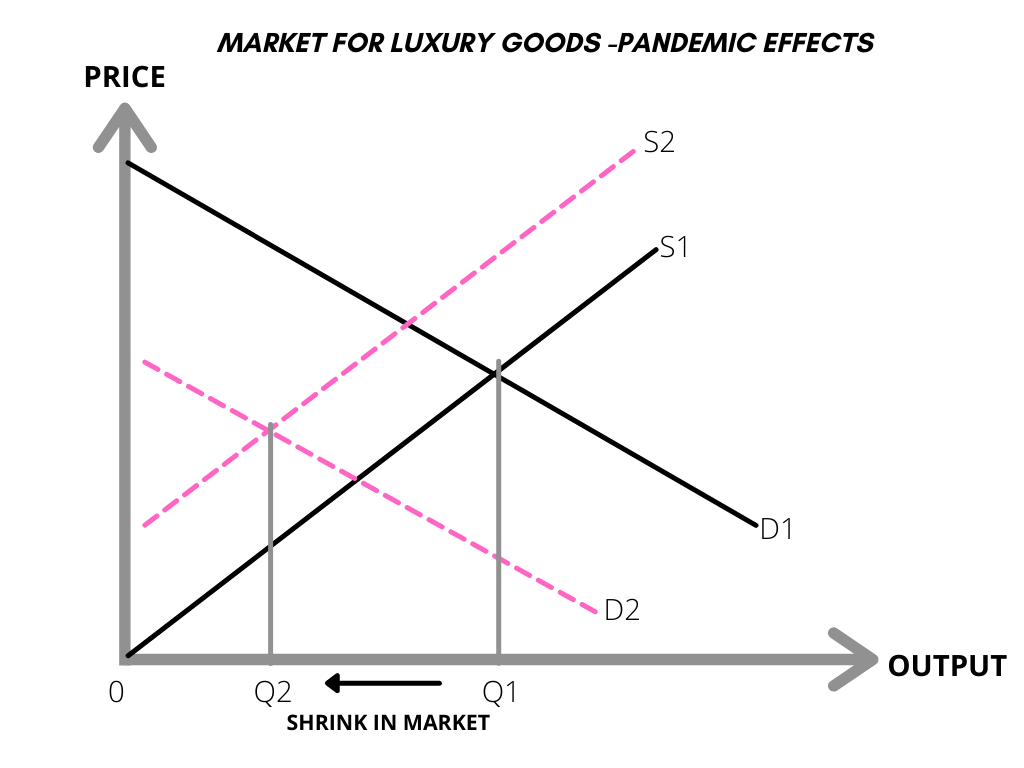

When the whole world’s production was at standstill, the pandemic largely showed its effect on both demand and supply-side factors; economists all over the world predicted not just a small pattern change in markets but also anticipated long-term retrospective effects.

The disaster to the world economy has a major portion of large-scale disruptions to luxury goods markets. High GDP economies saw a proportionate effect of the pandemic on the luxury preferences of consumers and their expenditure on extravagant items.

Short Term Impacts

The major effect of the pandemic was the lockdown which imposed restrictions on the production of majorly non-essential goods or goods with luxury aspects. By affecting production units and causing temporary unemployment, brands had to face large-scale implications due to expenses and temporary losses of the market.

Workers were laid off due to the high expenses of brands, which impacted employment and supply all over the world on a short-term basis. Resultantly, the market shrank.

The middle stages of the pandemic encouraged big brands to think of innovative marketing strategies and diversification of products to attract their consumers back to revive production and engage in the market. Many luxury clothing brands started producing masks and other essential infections preventing goods and thereby entered the market of essential goods.

‘’Louis Vuitton’s parent company LVMH declared it would convert its perfume factories to manufacture anti-viral solutions and also non-surgical face masks and hospital gowns. Gucci announced it would manufacture medical overalls for medical professionals, while Bvlgari transformed production towards handing out free-hand sanitizers for the Italian public services. So did Kering Group, the parent of French fashion houses such as Alexander McQueen, Yves Saint Laurent, Balenciaga, to produce 3 million surgical masks.’’

Analyzing the consumer side of the luxury market, demand has been adversely affected. The demand has shrunk by a larger gap than the supply of luxury items. There are valid reasons why the demand for high-priced goods would decline during such pandemic situations.

Due to initial lockdown stages all around the world, a large proportion of workers were laid off, losing the income capacities that they might have spent on luxury goods. While workers were able to get partial salaries in many countries, an individual would most likely spend their partial salary on necessary goods rather than on luxuries.

Further observing the trend, the middle-income group who earned a full income even during the pandemic were reluctant to spend it on luxuries.

In times of an unprecedented health crisis, many individuals focused on essential services and savings towards medical treatment. All these reasons were responsible for the large-scale short-term decline in demand for luxury goods in almost every economy of the world.

There was a big loss in highly volatile stock markets because of the value of FMCG(fast-moving consumer goods/survival essentials). Companies saw an amazing growth increment having the opposite impact on luxury goods markets. The stocks fell to all-time lows for the big companies with luxury services, further causing difficulty for brands to survive.

LONG TERM IMPACTS

COVID will surely leave imprints and change the trends of markets forever.

These changes in demand won’t disappear after a few months or years but will remain intact now onwards as people have realized how they spend more than they need.

This will impact future preferences of consumers of the luxury market as some will leave the market upon realizing their needs. They will focus more income on essential goods. Another possible reason for not spending on luxuries in the long term would be to save more for the uncertainty of life and situations like these.

The luxury supply side would also show long-term impacts as the demand might revive, but not enough to the pre-COVID levels. This means that fewer products will be introduced, forcing reduced production and leading to a slowdown in labor markets.

As a result of this slowdown, some luxury brands with fairly low market share might also permanently shut down. This will impact the whole economic structure in the long run and will require much time and strategies for firms to innovate their selling skills and regain customer loyalty.