Introduction

Finance in 2025 is no longer just about saving and investing—it’s about empowerment, automation, and financial resilience. The world of money is becoming more transparent, tech-driven, and tailored to individual needs. With AI-powered tools, decentralized finance (DeFi), and digital currencies reshaping the financial landscape, consumers and businesses are gaining unprecedented control over their economic futures.

Here’s a look at how finance is evolving in 2025—and what that means for investors, everyday users, and the global economy.

1. Personal Finance Goes Fully Digital

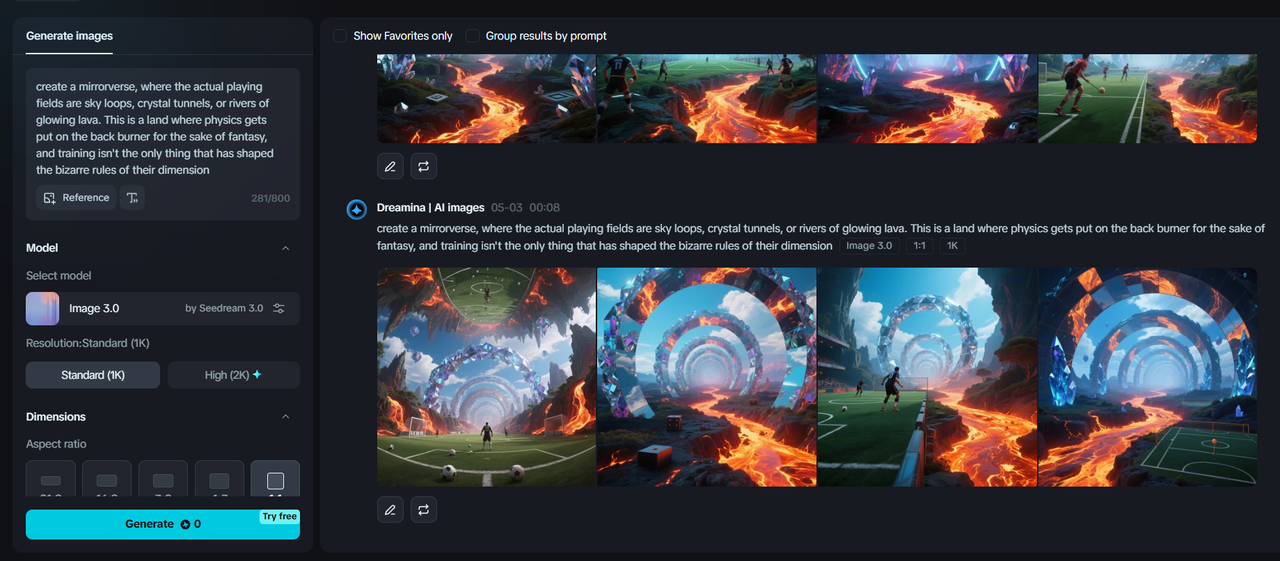

Gone are the days of spreadsheets and manual budgeting. In 2025, personal finance is managed through intelligent apps that analyze spending, optimize savings, and guide investment decisions in real time.

Trending tools:

- AI-driven financial advisors (robo-advisors)

- Smart budgeting apps that link to real-time bank data

- Automatic investing platforms with custom portfolios

Impact: Everyone—from students to retirees—has access to personalized financial guidance.

2. The Rise of Central Bank Digital Currencies (CBDCs)

Cash is fading fast. In many countries, central banks have introduced digital currencies that are secure, trackable, and accessible via smartphones.

Benefits of CBDCs:

- Faster, cheaper transactions

- Improved financial inclusion for unbanked populations

- Reduced fraud and corruption through traceable payments

Global trend: Governments are carefully balancing innovation with regulation to maintain financial stability.

3. Decentralized Finance (DeFi) Disrupts Traditional Banking

Blockchain is revolutionizing finance through DeFi platforms, allowing people to borrow, lend, trade, and earn interest without banks or intermediaries.

DeFi in action:

- Peer-to-peer lending platforms

- Crypto-based savings accounts with higher returns

- Smart contracts automating payments and settlements

Warning: While DeFi offers freedom, it also brings risks—regulation is starting to catch up in 2025.

4. Green Finance: Investing in a Sustainable Future

Finance in 2025 is not just about profits—it’s about impact. Investors are increasingly directing money toward Environmental, Social, and Governance (ESG) funds and sustainable business models.

Sustainable finance trends:

- Green bonds funding clean energy projects

- ESG metrics embedded in mainstream investment platforms

- Companies required to disclose environmental performance

Result: Capital is flowing into businesses that build a better planet.

5. The New Investor: Young, Informed, and Mobile-First

Thanks to commission-free trading apps and financial literacy content on social media, younger generations are entering the investing world earlier and smarter than ever before.

New investor habits:

- Trading stocks, crypto, and ETFs from mobile apps

- Following financial influencers for market tips

- Investing based on personal values and social trends

Outcome: The investor profile is changing—and reshaping market behavior.

6. Cybersecurity and Financial Data Protection

As more financial activity moves online, the need for robust cybersecurity is higher than ever. In 2025, financial institutions invest heavily in protecting user data and digital assets.

Security upgrades:

- Biometric authentication for online banking

- Blockchain for transaction transparency

- AI tools detecting fraud in real time

Key message: Trust in finance now depends on the security of digital infrastructure.

7. Financial Literacy Becomes a Global Priority

With finance becoming more complex, education is critical. Schools, employers, and fintech companies are making financial literacy a core part of learning and workplace training.

Education efforts:

- Mandatory personal finance classes in schools

- Online courses teaching investing, taxes, and budgeting

- Employer-sponsored financial wellness programs

Why it matters: An informed population makes better financial decisions—and builds stronger economies.

Conclusion

Finance in 2025 is faster, fairer, and more flexible than ever before. Whether you’re investing, borrowing, saving, or spending, the tools and opportunities are now at your fingertips. But with greater access comes the need for greater understanding.

In this new financial era, success belongs to those who embrace change, educate themselves, and use technology to their advantage. The future of money is here—and it’s in your hands.