Chancellor Announces £330bn Aid for UK Businesses

COVID-19 has had an immense impact on us all, and the UK is no exception. The UK economy has been plunged into its deepest recession yet. The Guardian states that the UK’s GDP has fallen by 20.4%, the worst of any G7 nation in the three months leading up to June.

The United Kingdom is utilizing monetary policy in order to reduce the impacts of this recession. Monetary policy refers to the use of interest rates - or the cost of borrowing money - via manipulating the money supply in order to influence aggregate demand.

Unemployment refers to the situation when people who are willing, able, and available for work are unable to find work. As a response to Covid-19, during the first week of March 2020, the Chancellor of the Exchequer announced a £330 billion loan and aid program for the British economy.

Chancellor Rishi Sunak announced that he is providing businesses with access to a government-backed loan of £330bn. He further put forth his commitment to providing as much assistance as required if the initial £330bn proves insufficient.

"This is not a time for ideology and orthodoxy, this is a time to be bold, a time for courage. I want to reassure every British citizen this government will give you all the tools you need to get through this.”

Will the adverse impacts of Covid-19 now be reduced?

The £330 billion in state-backed loans for all businesses through the banking system with help from the Bank of England comes in co-occurrence with interest rates falling to historic lows of 0.1% from the Central Bank. These drastic measures are likely to reduce the impacts of Covid-19 on the economy to some extent.

What will this mean for businesses?

They will be able to borrow at virtually non-existent rates if commercial banks pass this rate on. This would typically increase aggregate demand and increase spending. Along with this, it allows for “any viable business with a turnover of up to 45 million pounds would be able to apply to banks for a 12-month interest-free loan, 80% of which will be guaranteed by the government.” This will help small-to-medium-sized firms borrow up to 5 million pounds to deal with coronavirus stoppages.

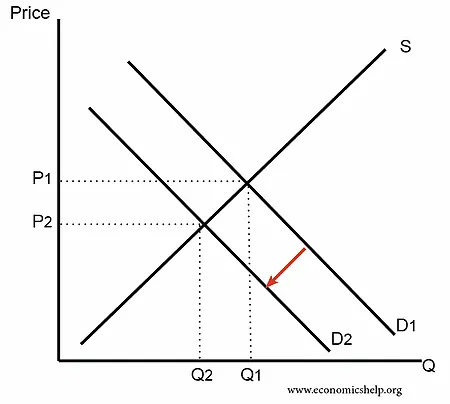

As a result of the lowering demand currently prevalent in the economy, firms adapt by reducing their supply as well:

Since the magnitude of the policy is large, its impact on domestic firms is going to be great. This monetary policy is vital for small-to-medium-sized firms as it allows any business making less than 45 million pounds annually to borrow at no interest.

In addition, for the temporary duration, a large maximum borrowing limit at the remunerative interest rate (GBP 5 million) would almost certainly satisfy small firms. Therefore, small and medium-sized firms can pay employees using government-insured money and not have to worry about actually paying the money back until later.

Another impact of this monetary policy would be that it would significantly decrease some firms’ financial capital supply. This is because we assume that consumers would refrain from making massive purchases and buying luxury goods for a while, meaning that the aggregate demand in the economy would be extremely low and the firms wouldn’t have to supply as much. Along with this, it is likely for business investment to be reduced because they would rather focus on stabilizing themselves after paying salaries whilst generating no revenue.

The massive spare capacity in the UK’s economy will make it impossible for this policy to sustain itself. A further increase in the AD of the economy could only be seen if the government implements an expansionary fiscal policy. It can be used to create an environment for long-term economic growth.

With the current situation, the best long term option would be government spending in ways to prepare the economy by liberalizing laws for hiring and firing workers. This will make private firms more likely to invest and set up businesses in the country. Government spending has a direct impact on the aggregate demand, increasing it, and this can help boost demand in the economy without causing crowding out. Automatic stabilizers like unemployment benefits and progressive taxes play a part.

As the nation’s GDP falls, governments increase their spending on unemployment benefits, and tax revenue falls (because of falling wages and the growing number of unemployed workers). However, if taxes are decreased, people may start saving their incomes and its impact would not be significant enough to overcome the recession.

Overall for the UK, as the coronavirus outbreak persists, the government will find it difficult to continue funding the budget in this way without placing inflationary pressure on the economy or opting for a long-term solution such as an expansionary fiscal policy. Countries around the world have taken fiscal actions amounting to about $8 trillion in order to contain the pandemic and reduce the adverse damage of COVID-19 to their economies.

The Group of Twenty advanced and emerging economies such as the United States and Germany, for example, have adopted measures such as extended unemployment benefits, payroll tax deferral, and wage subsidies to small and medium enterprises.

European countries have rolled out liquidity lifelines such as affordable loans and guarantees to help workers and self-employed entrepreneurs pay bills. Fiscal support has helped the economy in several of these countries and the UK can definitely benefit from employing such fiscal action.

Tags:

If you found this article, please share it: